Malaysia stands at a pivotal juncture in the global semiconductor landscape. Under the leadership of Dato Seri Anwar Ibrahim, our nation’s strategic geopolitical and economic policies are not only attracting significant foreign investment but also positioning Malaysia as a neutral haven amid the escalating chip war. This article explores how Malaysia can capitalise on this unique opportunity to become a central player in the semiconductor value chain.

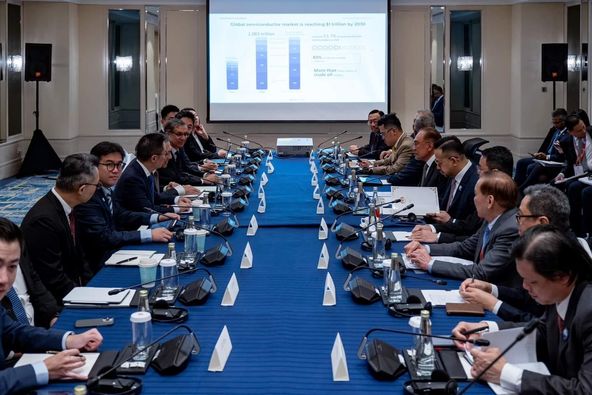

It was widely reported that Chengwei Capital- fronted by vocal and prominent venture capitalist from China, Eric Li- met with the Prime Minister in Shanghai last week during an official working visit to China that included high level bilaterals and official dinners with both the President and the Premier. I was honoured and humbled to be part of the delegation accompanying the PM and was in the meeting.

Chengwei Capital has an elite slate of semiconductor executives at its helm, with a specific focus and unique capacity to crowd technology and capital together for and from the microchip ecosystem. I saw and heard firsthand, the eagerness, enthusiasm and even urgency in investing in Malaysia. I believe it is a direct response to the government’s proactive stance amid escalating global tensions over rare earth elements, mineral confrontations, and the chip war.

Malaysia’s Value Proposition: Neutrality and ASEAN Centrality

The global semiconductor industry is projected to reach $1 trillion by 2030, driven by the proliferation of advanced technology in every sector. The industry is marked by high economic and strategic value, with a small number of economies — Taiwan, South Korea, the U.S., and Japan (often called the “Chip4”) — controlling the lion’s share of production and supply.

According to Chengwei Capital’s presentation, as of 2023, Taiwan is the leading economy in the global semiconductor market with 37% of the revenue, followed by South Korea at 20%, Japan at 10%, and the United States at 12%. These four economies collectively control over 79% of the market, and 53 of the entire ecosystem, underscoring their dominance in the industry.”

In 2023, the estimated global semiconductor imports were:

Taiwan: $36 billion

South Korea: $87 billion

Japan: $37 billion

U.S.: $85 billion

For the EU, which remains highly dependent on external sources, semiconductor imports were valued at approximately $120 billion.

China is the the largest importer of oil in human history, yet

China spends more annually on semiconductor imports than on crude oil and iron ore combined; manifesting its dependency and the impact of export restrictions on its economic stability. With recent export controls and the CHIP4 alliance intensifying supply chain restrictions, there is a growing opportunity for neutral economies like Malaysia to step in and provide alternative supply chain hubs.

Malaysia’s commitment to active neutrality, reinforced by ASEAN’s principles of centrality, offers a unique value proposition to global investors. This stance not only avoids entanglement in geopolitical conflicts but also fosters a stable business environment. Furthermore, Malaysia’s robust legal framework, strategic location, and established trade relationships make it an ideal hub for companies seeking to diversify their supply chains.

For neutral economies such as Malaysia, Vietnam, and others, imports and market value are poised for exponential growth due to increased demand for diversification. Malaysia, with an approximate 13% market share in semiconductor testing and packaging, is already well-positioned as a crucial player.

A Testament to Strategic Governance

The Madani Government’s leadership has positioned Malaysia as an attractive destination for global investors seeking stability and growth opportunities. Our active neutrality in foreign policy and commitment to ASEAN centrality have made Malaysia a safe haven amid geopolitical uncertainties. Chengwei Capital’s interest underscores the confidence that international investors have in our nation’s direction. They recognise that Malaysia is not just reacting to global shifts but actively shaping its role in the new economic landscape.

Malaysia possesses substantial underground deposits of rare earth elements. While we have established processing capabilities, they are limited and not fully sovereign. However, with the government’s strategic initiatives, there’s a concerted effort to develop a comprehensive “Mine to Microchip” value and supply chain within our shores. Our trained pool of talent and the range of mid to downstream manufacturing sectors, though currently underdeveloped, provide a solid foundation for growth.

Imagine a Malaysia where the minerals beneath our feet become the substrates of the world’s most advanced microchips—a full-circle journey from mine to microchip. This vision is economically compelling and serves as a symbol of national pride and self-reliance.

Chengwei Capital’s Strategic Interest

Chengwei Capital’s initiative to meet with our Prime Minister is more than a business proposition; it’s a strategic alliance. Their willingness to crowd capital, expertise, and technology transfer is driven by Malaysia’s proactive measures in addressing the challenges and opportunities presented by the escalating rare earth race and chip war. They see in Malaysia a partner ready to navigate the complexities of the global semiconductor industry with agility and foresight.

At the heart of our nation’s progress lies a simple truth: when we unite in purpose, we unlock unparalleled potential. The semiconductor industry isn’t just about chips and circuits; it’s about the embodiment of human ingenuity and the relentless pursuit of progress. By embracing this industry, we aren’t merely engaging in commerce; we’re making a statement about Malaysia’s place in the world—a nation that balances tradition with innovation, neutrality with ambition, and diversity with unity**.

I have submitted a Parliamentary special chamber motion, calling the government to undertake an in-depth critical minerals economic impact assessment and mapping, employing a “Mine to Microchip” value chain approach. This initiative should include a comprehensive Mineral Potential Assessment to develop an extensive inventory of available minerals and their mining byproducts. Policies must be forged and implemented to attract global semiconductor players. Streamline regulations, offer incentives for research and development, and invest in infrastructure that supports the entire value chain. Legislative reforms should facilitate mineral exploration while balancing economic growth with national interests.

I have also called for the Institute of Strategic and International Studies (ISIS) Malaysia, Ministry of International Trade and Industry to coordinate research to map existing businesses and activities along the value chain already operating in Malaysia, identifying potential gaps and opportunities. Based on this assessment, recommend policy changes to encourage, facilitate, and incentivize investments to fill these gaps and activate new opportunities.

All-of-nation approach is imperative

Local enterprises must partner with global leaders, adopt best practices, and invest in cutting-edge technologies. This is a call to elevate our industrial capabilities, moving beyond testing and packaging to upstream activities like wafer fabrication, silica mining, and rare earth separation. Businesses should explore mid to downstream manufacturing utilising processed rare earth products, capitalising on our nation’s resources.

Public and private further and higher educational and training institutions must work together to concertedly cultivate the next generation of engineers, scientists, and innovators. Universities and vocational schools should expand programs in semiconductor technology, materials science, and related fields. By aligning education with industry needs, we ensure a steady pipeline of talent ready to drive Malaysia’s ascent in the global value chain.

The formal education architecture must engage with and support this national endeavor. Public understanding and enthusiasm can fuel momentum, and the seeds must be sowed from the youngest possible age. From encouraging STEM education among youth to fostering a culture that values innovation and adaptability, every Malaysian has a role to play.

Opportunities of this magnitude are rare. To capitalize on this, we must act swiftly and decisively. The government’s policies must be enacted with precision, businesses must invest and innovate, educational institutions must adapt curricula, and the populace must support and participate in this national journey.

Malaysia stands on the cusp of a transformation that could define the next century of our nation’s prosperity. By uniting government action, business innovation, educational excellence, and public support, we can elevate Malaysia to new heights in the global semiconductor value chain.

Let us not be passive observers in the shifting tides of global economics. Instead, let us be active shapers of our destiny.

Howard Lee

MP for Ipoh Timor

Chairman of Parliamentary Caucus for Critical Minerals